South Africa Taps Into Contingency Reserves to Curb Escalating

South Africa’s government has revealed plans to draw down $8 billion over the next three years from contingency reserves held at the central bank in an effort to mitigate the escalating debt crisis, according to a statement from the National Treasury on Wednesday. The move comes against the backdrop of South Africa’s stagnant economic growth over the past decade, with mounting debt-servicing costs increasingly consuming a larger portion of the national budget.

The economic challenges are particularly significant as the country approaches a general election scheduled for May 29. This election holds the potential for the African National Congress party, which has governed since the end of apartheid 30 years ago, to lose its parliamentary majority for the first time.

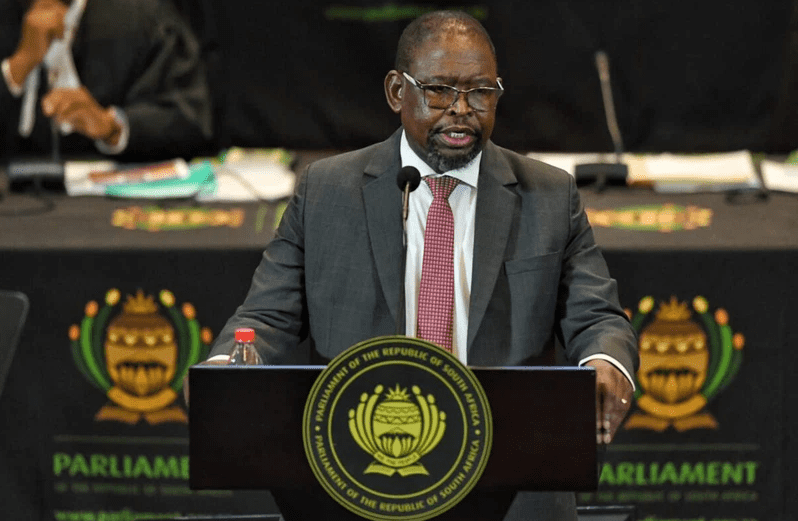

Presenting the 2024 budget, Finance Minister Enoch Godongwana explained that drawing down 150 billion rand ($7.93 billion) from the Gold and Foreign Exchange Contingency Reserve Account (GFECRA) is an unconventional move aimed at limiting debt without compromising the central bank’s solvency. The GFECRA, with a balance exceeding 500 billion rand, captures gains and losses on foreign currency reserve transactions.

The government is set to receive 100 billion rand in the next fiscal year, ending in March 2025, and 25 billion rand in each of the subsequent two years. Treasury Director-General Duncan Pieterse clarified that this drawdown effectively replaces more expensive borrowing, reassuring investors and contributing to a modest strengthening of the rand and the country’s sovereign dollar bonds.

In addition to the drawdown, the Treasury proposed 15 billion rand in tax increases for the next fiscal year to alleviate fiscal pressures. Consolidated spending is expected to rise to 2.6 trillion rand in fiscal year 2026/2027 from 2.4 trillion in 2024/2025. This includes increased allocations for health, education, and the extension of a social grant introduced during the COVID era.

With these measures, the government aims to stabilize gross debt at 75.3% of gross domestic product in 2025/2026, a slight improvement from the previously projected 77.7% ratio in November. The budget reflects a comprehensive strategy to navigate economic challenges, reduce debt burdens, and prioritize essential sectors in the face of uncertain political and economic landscapes.