South Africa’s Inflation Outlook: Central Bank Governor’s Analysis

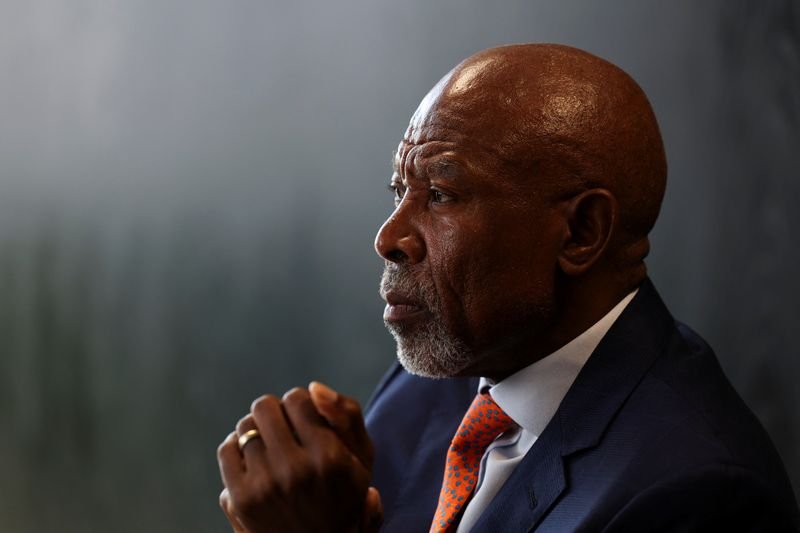

According to Central Bank Governor Lesetja Kganyago, South Africa’s inflation outlook faces potential upward pressures. Despite adverse El Nino weather conditions wreaking havoc across Africa, recent data has not indicated significant price pressures, particularly in food prices.

On Wednesday, data revealed that headline inflation had dropped to 5.3% year-on-year, a slight decrease from 5.6% in February and slightly below analyst forecasts. However, in its March decision, the South African Reserve Bank (SARB) noted that headline inflation was expected to reach 4.5%—the midpoint of its target range—only by the end of 2025, later than anticipated.

Kganyago, speaking to Reuters during the International Monetary Fund and World Bank spring meetings in Washington, highlighted the potential risks to the inflation outlook. These risks include higher oil prices due to tensions in the Middle East and the possibility of tight global financial conditions, particularly if U.S. Federal Reserve interest rates remain elevated.

He emphasized that such conditions could lead to capital outflows from emerging markets like South Africa to advanced economies, potentially causing exchange rate adjustments. The South African rand has weakened by more than 4% against the dollar since the beginning of the year.

While food price pressures have been a concern across Africa due to droughts and adverse weather, Kganyago noted that South Africa has not yet experienced significant effects from El Nino conditions.

South Africa, Africa’s most industrialized nation, is grappling with economic challenges and high debt ahead of a general election on May 29. There is speculation that the governing African National Congress party may lose its parliamentary majority for the first time since the end of apartheid 30 years ago.

In response to concerns about election uncertainty, Kganyago pointed out that this is a global phenomenon, with numerous countries worldwide holding elections. This underscores the broader context in which South Africa’s economic challenges and policy decisions unfold.