Lagos Mega Refinery: Dangote Seeks to Establish Trading Arm for Operations

Africa’s wealthiest individual, Aliko Dangote, is contemplating the establishment of an oil trading division, likely headquartered in London. The primary objective is to streamline the management of crude oil and product supply for his recently constructed refinery in Nigeria. Six sources familiar with the matter disclosed this information, emphasizing that the move would diminish the involvement of major global trading firms.

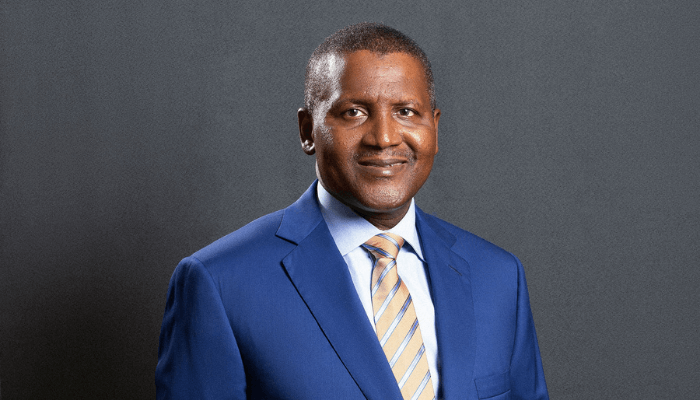

Dangote’s colossal 650,000 barrel-per-day refinery is poised to reshape worldwide oil and fuel dynamics, prompting intense scrutiny from the trading community. Despite numerous efforts, Aliko Dangote, valued at $12.7 billion by Forbes, has not responded to several requests for comments.

Leading trading entities like BP, Trafigura, and Vitol have engaged in discussions with Dangote, both in Lagos and London, in recent weeks. Their proposals involve extending loans amounting to approximately $3 billion in working capital to facilitate the refinery’s crude oil purchases. The catch is that these trading firms expect repayment in the form of fuel exports. However, Dangote has hesitated to finalize any deals, expressing concerns about potential compromises to his control over the project and subsequent profits.

In his pursuit of financial backing and crude oil, Dangote has also held discussions with state-backed firms. Industry sources revealed that Aliko Dangote is leaning towards establishing an independent oil trading team to navigate these intricacies. The team is expected to be led by Radha Mohan, a former Essar trader who joined Dangote in 2021 as the Director of International Supply and Trading, according to his LinkedIn profile. Additional sources indicated that the team is actively recruiting two new traders.

Despite its monumental potential, the Dangote refinery experienced significant delays, taking almost a decade to complete and surpassing the initial budget by $6 billion, with a total cost of $20 billion. Operational since January, the refinery has processed around 8 million barrels of oil between January and February, gradually working towards its full capacity. Notably, trading giants Vitol and Trafigura have played a role in supporting the refinery, with Vitol prepaying for certain product cargoes, while Trafigura engaged in crude oil swaps for future fuel cargoes. Both companies, based in Geneva, declined to comment on the matter. The unfolding dynamics around Dangote’s refinery underscore the intricate financial maneuvers and strategic considerations within the global oil and trading landscape.